Blockchain InsightsImpermanent Loss & You

Recently, the Osmosis Governance approved another set of external incentive matching for the BTSG pools. I wanted to analyze at how these pools perform if you ignore incentives. Simply Swap Fees Accrued vs Impermanent Loss. When you put tokens in a pool, you're now investing in the GAMM itself. When people use the pool, the swap fees go to the GAMM holders, which increase the tokens represented by the GAMMs.

With impermanent loss, your GAMMs end up representing omre of the token that underperforms in a pool, but does that mean you have less money than if you had just held both tokens? Not necessarily! In this example, if you had invested in the BTSG/OSMO pool on October 31st, block 1800000 in the charts, your GAMMS would actually gained in value by 3.45% as of January 1st, block 2620000.

| Block | uBTSG | uOsmo | BTSG Price | Osmo Price | GAMM-573 Value |

|---|---|---|---|---|---|

| 1800000 | 0.822 | 0.0735 | 0.483 | 5.40 | $0.000000794 |

| 2620000 | 0.977 | 0.0636 | 0.420 | 6.46 | $0.000000821 |

So the GAMM's performance: ($0.000000821-$0.000000794)/$0.000000794 ~ 3.45%

And the impermanent loss would be calculated as:

(Amount of UBTSG at Start) * (Current uBTSG Price) + (Amount of uOsmo at Start) * (Current uOSMO Price) - (Current GAMM Values)

Which comes out to: (0.822 * $0.420/1000000 + 0.0735 * $6.46/1000000 - $0.000000821)/ $0.00000082 ~ -0.12%

The division by a million is to convert BTSG/OSMO price to uBTSG/uOsmo price. Note that the % loss is negative~ This means that we don't have any losses, and instead actually have an 'impermanent gain'. Though in this case its a relatively small amount.

Again note that this doesn't include external/internal incentives and the compounding of those incentives. The reason for this is because the incentives are temporary and I wanted to compare the ROI of a pool to just holding the tokens. Hopefully super fluid staking will come out and I can run these numbers again but assume the Osmo portion is being staked and compare that to just staking the individual tokens by themselves.

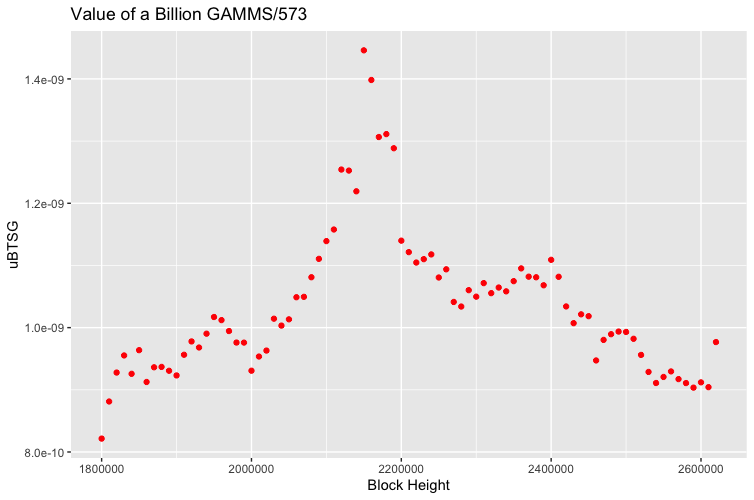

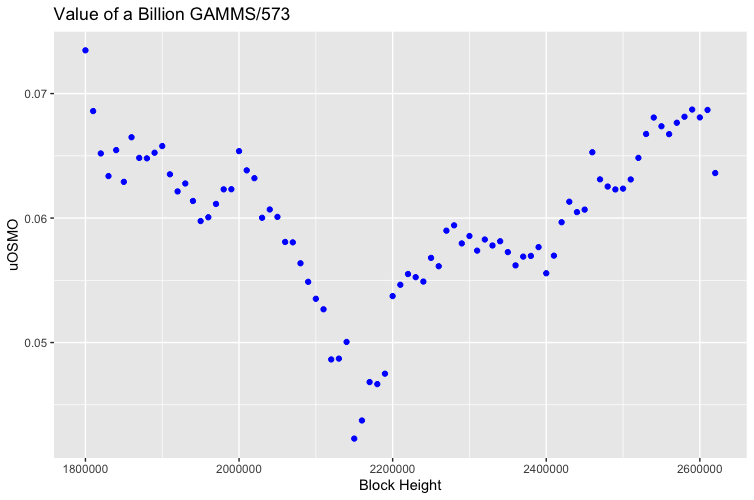

We can expand this past our example case and view the IL of this pool in action by plotting the amount of Bitsong and Osmo represented by a GAMM!

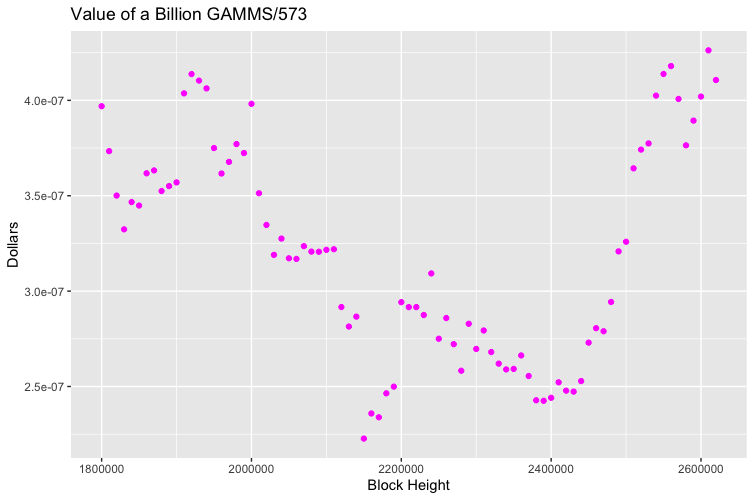

Lastly, lets see how this IL impacts the price of the GAMM itself while the swap fees accur!

The two pool tokens have an inverted relationship, as expected due to IL. The USD chart follows a bit of its own pattern as its focused on the USD value of the tokens moreso than the amount of each in the pool. Eventually though, you can see the USD value of the GAMM overcomes IL and becomes emore valuable than it started!

To summarize, when picking a pool to invest in, IL is definitely an important thing to consider. What people fail to consider, is the value of swap fees in balancing out IL. As we've demonstrated just now, swap fees can be fairly effective at matching or overcoming IL! The most important things to keep in mind when picking a pool is the APR Incentives -internal and external- plus how bullish you are on the assets in the pool.