Blockchain InsightsOsmosis in Graphs: The value of an Osmo

Everyday, millions of dollars are traded in and out of Osmosis pools. From users compounding their LP rewards to traders exchanging tokens, every transaction slowly yet surely increases the TVL of Osmosis. When the TVL of Osmosis increases, the price of an Osmo tends to follow. In this post, we’re going to take a deep dive into the pricing of an Osmo.

Note that pricing and other data points are based on the Epoch Block for Sunday February 13th. When referring to TVL, I’m not including the value of the Osmo in the pools. This is because I hope to demonstrate how the value of an Osmo is simply a reflection of the value of all the tokens paired with it in Osmosis liquidity pools.

Since the majority of Osmo’s liquidity is in Osmosis, the price of an Osmo can be defined by what you can swap it for. Osmo is the main trading pair of Osmosis, w/ Osmo existing in 420 of the 639 current pools. This means that the price of an Osmo can be roughly estimated as the TVL of each pool’s non-Osmo assets divided by the total number of Osmo in a pool. A rough formula for this might be written as:

Let’s use a simple example. Imagine there were two pools on Osmosis, an ATOM/OSMO pool and an AKT/OSMO pool. The make up of these pools are:

Pool 1: 4 ATOM/24 OSMO

Pool 2: 10 AKT/5 OSMO

Now let’s say the price of an ATOM is $24 and the price of an AKT is $2. We have a total of 29, 24+5, Osmo in bonded in the pools. The value of the non-Osmo tokens is equal to $116:

So 29 Osmos are worth $116, which gives us a value of $4 an Osmo ($116/29). Every time a pool is added to Osmosis that includes Osmo, more Osmo are required to maintain the price of an Osmo. For example, let’s say a Bitsong is worth $0.20 on a second exchange. A third pool, BTSG/OSMO, is created w/ 100 BTSG ($20) and 5 new Osmo (4 *5 = $20). Now the TVL of Non-Osmo assets is $136 and there are 34 (29 + 5) Osmo in the pools. $136/34 is $4. The price of an Osmo stayed the same but now it takes 34 Osmo in the pools to hold that price.

What if the creator of the BTSG/OSMO pool didn’t have 5 additional Osmo?

What if they only had 3 Osmo in their wallet? Now the pools look like this:

Pool 1: 4 ATOM/24 OSMO (1 OSMO = 1/6 ATOM = $4)

Pool 2: 10 AKT/5 OSMO (1 OSMO = 2 AKT = $4)

Pool 3: 100 BTSG/3 OSMO (1 OSMO ~ 100/3 BTSG ~ $6.67)

One of these things is not like the other. The Osmo in pool 3 are overpriced! Fortunately for us, there are Arbitrage Bots that look for these situations and correct them. They do this by moving Osmo from the undervalued pools (1 and 2) into the overvalued pool (3). The bots take the mis-priced tokens and sell or swap them for a profit. We won’t delve too deeply into this process as it’s not the primary focus of this post, but at the end of the day all the pools will be balanced again. If we look at our TVL from before $136, and our number of Osmo (29 + 3 = 32), we can see that the price of an Osmo in this situation is $136/32 = $4.25. So adding a new Osmo pool ended up helping the price.

On the other hand, adding a new pool with too many Osmo can reduce the price. Imagine that Pool 3 was created with 100 BTSG/107 OSMO. The same bots would come and move everything around, but when we look at our TVL ($136) vs number of Osmo (29 + 107 = 136), an Osmo is suddenly worth $1! The value of an Osmo went down as significantly more Osmo were added to the pool than TVL.

What about the pools that don’t have Osmo in them? Those pools are helpful in maintaining stable prices & cheaper exchange rates. The con to these pools is that their TVL does not impact the pricing of an Osmo. No matter how many tokens sit in these pools, there’s no need to match their value w/ Osmo. So they don’t place any positive or negative pressure on the price of an Osmo.

What if those pools didn’t exist? What if every pool had to be an Osmo/X pool? How would that impact the price of an Osmo over time? To calculate that, we simply have to look at the TVL of non-Osmo pools and add it to the existing formula.

We cannot simply assume everyone would keep their tokens in Osmosis if they had to use an Osmo pool. Perhaps they would not have joined Osmosis in the first place if non-Osmo pools didn’t exist.

We’ll consider three situations:

1. 50% of the TVL in Non-Osmo pools migrates to Osmo pools.

2. 100% of the TVL in Non-Osmo pools migrates to Osmo pools.

3. None of the TVL stays & there’s less adoption due to forced Osmo usage

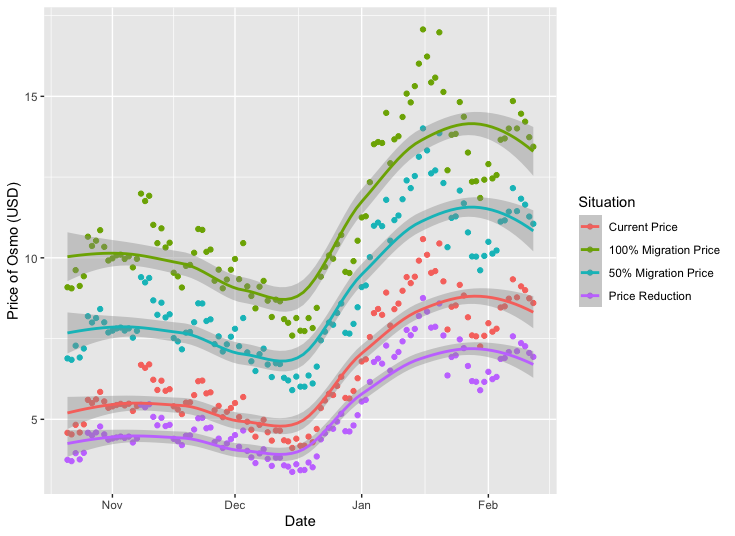

Let’s take a look at the last few months of Osmosis price action:

The dots represent the actual price points, the lines and their grey bands are a smoothed out approximation. The bullish case shows the Osmo ATH at almost $17.00 when accounting for all TVL. That’s a roughly 2/3rds increase from actual Osmo ATH.

The bearish case has Osmo never breaking $10 and closer to $6 today.

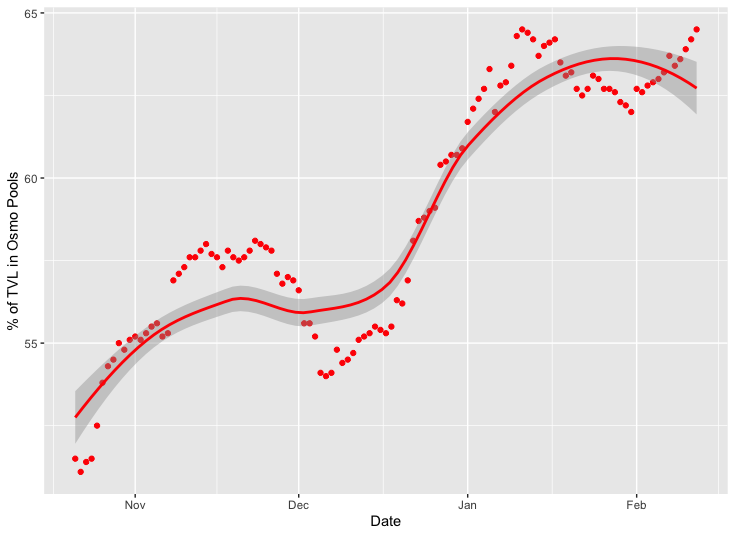

While it may still be tempting to remove or disincentive non-Osmo pools, one should note that the market itself is already heading in that direction:

From late October to mid February, we’ve seen the % of TVL paired w/ Osmos grow from ~50% to almost 65%. Osmo pools already have an incentives bias for both external & internal incentives. This paradigm shift is likely owing to the growth of Osmosis as a whole and has strengthened general belief in the Osmo token. Super Fluid Staking should have a similar impact as well.

Overall, the general trend has been positive for Osmosis! Lots of good things to look forward to as well. I hope that in reading this, you’ve come to understand how an Osmo is priced & why TVL is critical for the value of the Osmosis DEX and the Osmo token.